Saving money can feel overwhelming, especially when expenses stack up quickly.

But what if you could make saving easier just by changing when you save? That’s the beauty of a biweekly savings plan.

It’s a simple yet powerful strategy that helps you build your savings consistently, without feeling deprived.

Related Post: How to Start Working Remotely with No Experience

In this post, we’ll break down how a biweekly saving plan works, why it’s effective, and how to set one up even on a low income.

This article includes affiliate links. If you make a purchase through these links, I may earn a commission at no extra cost to you. Your support is highly appreciated.

What is a Biweekly Saving Plan?

A biweekly savings plan is a method of saving money every two weeks instead of monthly.

Most people who get paid biweekly already follow this schedule for their income.

By saving right after each paycheck, you develop a steady rhythm of setting money aside before it disappears into daily expenses.

Over the course of a year, you’ll have 26 pay periods. That’s two extra savings opportunities compared to a monthly plan, which only gives you 12.

Why Biweekly Saving Works Better Than Monthly Saving

Smaller, More Manageable Amounts

Instead of saving $400 a month, save $200 every two weeks. It feels easier and less stressful.

Builds Strong Habits

Since you’re saving more often, it becomes a consistent habit, not a once-a-month chore.

Perfect for Budgeting with a Paycheck Cycle

If you get paid biweekly, saving on the same schedule fits naturally into your budget.

Extra Paychecks

In two months out of the year, you get a third paycheck. That’s a great chance to boost savings even more.

Faster Progress

Saving biweekly means you can reach your goals—whether it’s $1,000 or $10,000—quicker than you might think.

How to Start a Biweekly Saving Plan

Here’s a step-by-step guide to help you set up your biweekly savings routine:

1. Know Your Pay Dates

Look at your calendar and highlight your paydays. You’ll be saving every two weeks on the same schedule.

2. Set a Realistic Goal

Decide what you’re saving for: emergency fund, vacation, new phone, car, or home down payment. Break the total into 26 parts.

Example: If your goal is $2,600 for the year, save $100 every two weeks.

3. Automate Your Savings

Set up automatic transfers from your checking account to your savings account every payday. This removes the temptation to skip a week.

📱 Join Our WhatsApp Food Channel!

Get daily ideas, decor tips, and exclusive room stylish deals — straight to your phone. Don’t miss out!

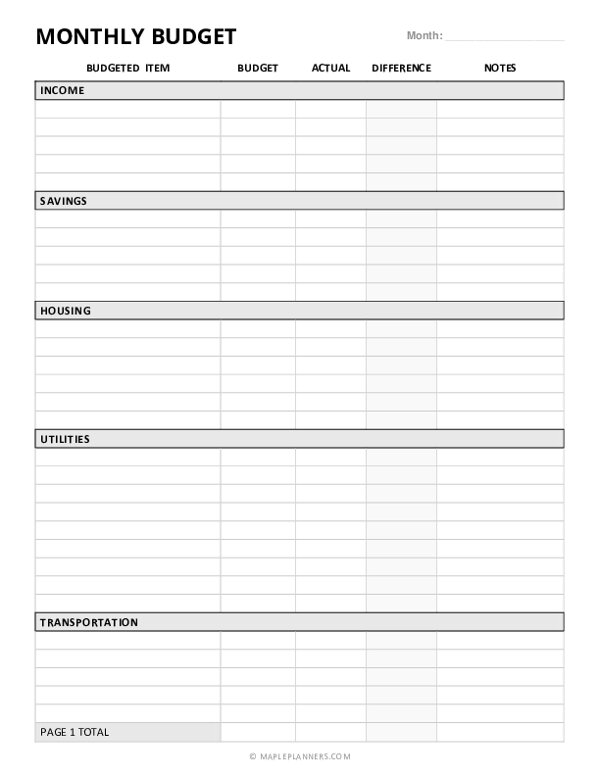

👉 Join Now4. Use a Biweekly Savings Chart

Visual progress helps you stay motivated. Create or print a chart to check off each deposit. You can also find printable trackers online or apps that do it for you.

5. Track and Adjust as Needed

Life happens. If you need to lower or skip a deposit, don’t give up—just adjust. Stay committed and consistent.

Sample Biweekly Saving Plans

Here are some sample plans based on different goals:

| Goal | Biweekly Deposit | Total in 12 Months |

|---|---|---|

| Emergency Fund | $50 | $1,300 |

| Vacation Fund | $75 | $1,950 |

| Christmas Gifts | $40 | $1,040 |

| Rent Backup | $100 | $2,600 |

| Big Purchase | $200 | $5,200 |

Tips to Stay Motivated

-

Name Your Savings Account (like “Paris Trip” or “Rainy Day Fund”)

-

Use Savings Challenges (like a 26-week biweekly challenge)

-

Celebrate Small Wins (reward yourself every time you hit a mini goal)

-

Review Your Progress Monthly

Who Should Use a Biweekly Saving Plan?

Biweekly savings are ideal for:

-

People with regular biweekly paychecks

-

Families looking to budget smarter

-

Students saving for tuition or supplies

-

Anyone who struggles with saving large amounts at once

-

Low-income earners who need a steady plan

Read More: Biweekly Savings Plan for Low Income

Final Thoughts

A biweekly savings plan makes saving money simpler, less painful, and more consistent.

It fits seamlessly into your pay schedule and helps you build wealth one step at a time.

Whether you’re just starting or trying to level up your finances, this method can help you reach your financial goals faster.

Start small if you need to, but start today—your future self will thank you.

Also Check: How To Sell Handmade Crafts or Art

FAQs About Biweekly Saving Plans

1. Can I start a biweekly savings plan without a steady income?

Yes! Even if your income is irregular, you can create your own biweekly calendar and save smaller amounts.

2. What’s the best account for biweekly savings?

Use a high-yield savings account or a separate bank account you don’t access often to avoid spending.

3. How can I stay consistent?

Automate your transfers and use a visual tracker to build momentum.

4. What if I miss a deposit?

Don’t stress. Just continue the next cycle. You can even spread the missed amount over a few future weeks to catch up.

5. Can I use this plan for debt repayment instead?

Yes! The same structure works great for paying off credit cards or loans biweekly.

📱 Join Our WhatsApp Food Channel!

Get daily ideas, decor tips, and exclusive room stylish deals — straight to your phone. Don’t miss out!